1. Financing

It is always advisable to consider how to finance the purchase in Spain before actively looking for property, so as not to lose precious time and secure the property of your dreams. In Spain there is the possibility to apply for a mortgage from a Spanish bank for financing. This can cover up to 70% of the property purchase price.

2. Viewing

In a mutual exchange we select the most suitable properties according to your criteria and requirements and put all our know how, skills and network at your disposal to guide you to your goal in the shortest possible time.

During the visit we take time for you and show not only the selected property, but also the surrounding area, so that you get a good impression of the place and a better feeling.

3. Legal advice

We clearly recommend to get legal advice from a professional in advance. Among other things, a lawyer will make sure that there are no obstacles in the land register, that there are no debts, tax burdens or other things that could be a burden to you. In this context, we can also help you to apply for a NIE (Número de Identidad de Extranjero) identity card number and a Spanish bank account. These things are indispensable to buy a property in Spain.

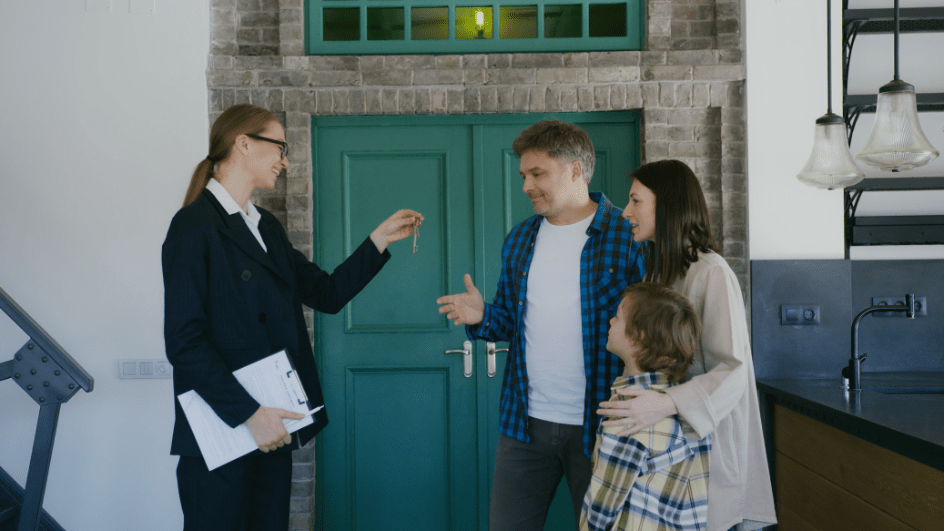

4. Final payment

The final final step in the real estate purchase occurs at the notary. Here, the buyer and seller or agents and / or lawyers meet to sign the title deed. Finally, the buyer pays the remaining purchase price and the seller hands over the keys. The contract is thus final and the buyer from now on the rightful owner, which is preserved by notarial legal title.

Call us

Our Email

info@soleado.org